Recently, the Supreme Court Constitution Bench in Vivek Narayan Sharma v. Union of India, 2022 SCC Online SC 1 has upheld by a 4:1 majority the notification of demonetization taken six years ago by the Union Government to demonetize the currency notes of Rs. 500 and Rs.1000. Justices S Abdul Nazeer, BR Gavai, AS Bopanna, V Ramasubramanian gave the majority opinion whereas Justice BV Nagarathna dissented.

Before delving into the

analysis of the judgment, let’s understand what demonization is. Demonetisation

is referred to as “the process of

stripping a currency unit of its status to be used as a legal tender” In

simple words, demonetization is the process by which the demonetized notes ceases

as a legal currency, and no transaction can be done by it, i.e., the legal

currency that is demonized has no value in the eyes of the law.

Background

of the Case

A notification dated 8th November 2016 was issued by the Central Government declaring that bank notes of denominations of five hundred rupees and one thousand rupees shall cease to be legal tender with effect from 9th November 2016. The said notification was issued in the exercise of the power conferred to the Central Government under Section 26(2)[i] of the Reserve Bank of India, 1934. Soon after the issuance of the said notification, several writ petitions were filed in different High Courts and also the Supreme Court. Hence, for the sake of convenience and transfer petitions filed by the Union, the issue was taken up by the three-judge bench of the Supreme Court, which further transferred it to the present five-bench judge. It is to be noted that there are many different issues tackled by the hon’ble Supreme Court, but I would like to elucidate the points important for CLAT PG & Other Law Entrance Exams.

Issued

framed by the Court & Its Reasoning

Issue 1: Whether the

Central Government can demonetize ‘all’ currency notes of a denomination

through a notification under S.26(2) of the RBI Act?

To find a solution to this issue, the Supreme Court analyzed the word “any” series of bank notes of any denomination shall cease to be legal tender. While analyzing the word “ any”, the Court referred to an important principle of interpretation of statutes i.e. Purposive Interpretation.

It referred to a plethora of cases, such as Modern Dental College and Research Centre, M/s Girdhari Lal and Sons v. Balbir Nath Mathur, and observed that purposive interpretation is the one that adds value to the purpose of the act or advances the purpose of the act. Such interpretation ensures that a smooth and harmonious working must be chosen and any interpretation that causes confusion, or friction between various provisions, and that tends to destroy the purpose of the act must be neglected. Hence, it is the duty of the Court to strive to interpret the statute to promote or advance the object and purpose of the enactment. And for the fulfilment of this duty, the Court can part from the plain meaning of the word.

The Supreme Court further

analyzed the purpose of Section 26(2) of the RBI Act which gives power to the

Central Government to demonetize any notes, on recommendation from the Supreme

Court. And, viewed as follows:

- The policy of Section 26 is to give power to the Central Government to demonetize any notes, on the recommendation by the Central Government. Basically, to effect demonetization.

- The legislative policy is with regard to the management and regulation of currency and demonetization is part of such management and regulation of currency.

- The Central Government may take recourse to the power under Section 26(2) of the RBI Act when it finds it necessary to do so to take into consideration myriad factors. But such factors must have a reasonable nexus with the object to be achieved.

- The Supreme Court opined that if the Central Government finds that fake notes of a are in circulation or that they are being used to promote terrorism, “that out of 20 series of bank notes of a particular denomination, it can demonetize only 19 series of bank notes but not all 20 series? In our view, this will result in nothing else but absurdity and the very purpose for which the power is vested shall stand frustrated”

- Hence, the word “any” would mean “all” under sub-section (2) of Section 26 of the RBI Act. And, the restrictive meaning to the word will defeat the overall objective of the section.

Issue 2: Whether Section

26(2) of the RBI Act allows the Union to demonetize ‘all’ currency notes, does

it grant excessive power to the Union?

It was contended that Section 26(2) of the RBI Act vests “unanalysed, unguided and arbitrary powers” in the Central Government and the provision is liable to be struck down. In this aspect, the Supreme Court delved into the concept of delegated legislation and referred to a plethora of cases Hamdard Dawakhana (Wakf) Lal Kuan, Delhi and another, Harakchand Ratanchand Banthia and others, etc. Also, referring to the case of Rojer Mathew Case, the Supreme Court observed that “a mere possibility or eventuality of abuse of delegated powers in the absence of any evidence supporting such a claim, cannot be a ground for striking down such a provision.”

Further, the Apex Court

observed the important role of the RBI as a Central Bank to justify the

fairness of the delegated legislation. It observes that RBI, a bankers’ bank,

is a creature of statute and one of its important functions is to regulate the

banking system in the country. In the case of Peerless General Finance and

Investment Co. Limited and another, it was held that “it is not permissible for a Court to advise in matters relating to

financial and economic policies for which bodies like the Reserve Bank are

fully competent.”

Hence, the Supreme Court

held as follows:

- From various cases, the Court has consistently recognized the pivotal role assigned to the RBI

- Since the decision of demonetization under Section 26(2) of the RBI Act is taken by the Central Government on the recommendation of the Central Board of the RBI, the Court found that there is an inbuilt safeguard as a recommendation from RBI is compulsory.

- The Supreme Court substantially referred to the case of Harakchand Ratanchand Banthia and others wherein, though the Constitution Bench found Section 5(b)(2) of the Gold (Control) Act, 1968 to be unconstitutional on the ground of vice of excessive delegation, it upheld the provisions of Section 5(2)(a) of the Gold (Control) Act, 1968, finding that there was an inbuilt safeguard inasmuch as the Administrator was required to take a decision after consultation with the RBI.

- Hence from the scheme of RBI Act, Section 26(2) provides sufficient guidance to the delegatee i.e the Central Government in regard to provisions of the RBI Act

- Parliament has an inbuilt safeguard i.e recommendation of the RBI.

- It referred to the case of Birla Cotton, Spinning and Weaving Mills Delhi that held the delegation was made to an elected body, responsible to the people including those who pay taxes.

- Under Section 26(2), the delegation is to the Central Government, i.e. the highest executive body of the country. Hence, unreasonable acts of the executive arise the responsibility of the parliament which is representative of the citizens.

Hence, Section 26(2) of the

RBI Act does not suffer from the vice of excessive delegation.

Issue 3: Whether the

implementation of the 2016 demonetization scheme is flawed?

It was contended that

decision making power at the stage of making recommendations by the Central

Board and at the stage of taking decisions by the Central Government is flawed,

as irrelevant factors were taken into consideration to enforce demonization.

To answer this issue, the Scope of Judicial Review was taken

into consideration:

The Supreme Court referred to the landmark case of Tata Cellular Case, which held: “The Supreme Court must confine its judicial review to the question of legality i.e if the decision-making authority exceeds its power, committees an error of law, breached the rule of natural justice.” The Court also referred to M/s. Prag Ice & Oil Mills and Another v. Union of India, R.K. Garg v. Union of India and Others and a recent case of Small Scale Industrial Manufacturers Association (Registered) v. Union of India and Others, to come to a conclusion that it is not the function of this Court to sit in judgement over such matters of economic policies. And, they can certainly not be expected to decide them without even the aid of experts. Hence, the Court examined the said demonization on legal grounds. And, found that it was not arbitrary

The Supreme Court held as

follows:

- The Court scrutinized all the documents and rationale for demonization i.e infusion of Fake Indian Currency Notes (FICN) and generation of black money. And, the adverse effect of the two highest denominations of Indian banknotes of Rs.500/- and Rs.1000/-. It also observed that RBI Central Board did consider the pros and cons of the measure. The inconvenience faced by the public was also taken into consideration by the cabinet and the decision-making did not suffer from non-consideration of relevant factors.

- The RBI and the Central Government were in consultation with each other for a period of six months before the impugned notification was issued. Hence, it cannot be said that it was a hastily made decision and the consultation was not purposeful.

- The action which was taken by the Central Government by the impugned Notification has been validated by the 2016 Ordinance and has been fructified in the 2017 Act.

- The ‘hasty’ argument would be destructive of the very purpose of demonetization. Such measures undisputedly are required to be taken with utmost confidentiality and speed.

Therefore, the Supreme

Court did not find any flaw in the decision-making process as required under

Section 26(2) of the RBI Act.

Issue 4: Whether the demonetization exercise is liable to be struck down by applying the test of proportionality?

It was contended that the act of demonetization caused hardships to a number of citizens; hence the Government ought to have found out whether there was an alternate course of action which could have resulted in lesser hardship to the citizens.

Here, the question of the test of proportionality comes into the picture. The Supreme Court referred to the case of Modern Dental College and Research Centre it elucidated four tests of proportionality:

- “It should be designated for a proper purpose.

- The measures undertaken to effectuate such a limitation are rationally connected to the fulfilment of that purpose.

- The measures undertaken are necessary for that there are no alternative measures that may similarly achieve that same purpose with a lesser degree of limitation.

- There needs to be a proper relation between the importance of achieving the proper purpose and the social importance of preventing the limitation on the constitutional right.”

The Supreme Court on this

issue held as follows:

- The demonization was designated for a specific purpose: i.e elimination of fake currency, black money and terror financing are not proper purposes. Hence, the right of the citizens under Article 300-A to hold bank notes was limited by a specific purpose.

- There is a reasonable nexus between the measure of demonetization with the purposes of addressing issues of fake currency bank notes, black money, drug trafficking & terror financing.

- Whether an alternative remedy can be taken by the Central Government in all the areas which are purely within the domain of the experts, that is RBI is beyond the arena of judicial review.

- The Court observed that in demonization, the rights vested in the notes were not taken away. The only restrictions were with regard to the exchange of old notes with new notes, which were also gradually relaxed from time to time.

- Hence, it passes all the tests of proportionality.

Therefore, the impugned

notification dated 8th November 2016 does not violate the principle of

proportionality and as such, is not liable to be struck down on the said

ground.

Issue 5 & Issue 6: Was

the 52-day window provided to exchange demonetized notes unreasonably short?

Can the RBI exchange demonetized currency after the 52-day window?

It was claimed that the exchange of old notes with new notes under the impugned Notification is unreasonable. The Supreme Court referred to the case of Jayantilal Ratanchand Shah which held that in previous demonetization in India (1978) if the time for such exchange was not limited, the high denomination bank notes could be circulated and transferred without the knowledge of the authorities concerned. And the very purpose of the demonetization would be defeated.

And, in regard to the question of can the RBI exchange demonetized currency after the 52-day window. The Court observed that the RBI does not possess independent power to do so as per the 2017 Act.

Dissenting

opinion:

Justice Nagarathna

differentiated in two issues:

Whether the Union demonetize

‘all’ currency notes of a denomination through a notification under S.26(2) of

the RBI Act?

Justice Nagarathna observed

the following:

- The Central Government did not possess the power to demonetize all series of bank notes, all denominations could not be recommended to be demonetized, by the Central Board of the Bank under Section 26 (2) of the Act.

- Section 26(2) of the RBI Act applies only when a proposal for demonetization is initiated by the Central Board of the Bank by way of a recommendation being made to the Central Government.

- On receipt of a recommendation from the Central Board of the Bank for demonetization under Section 26 (2) of the Act, the Central Government may accept the said recommendation or may not do so.

- If the Central Government accepts the recommendation, it may issue a notification in the Gazette.

- The Central Government may also initiate and carry out demonetization, even in the absence of a recommendation by the Central Board of the Bank.

With regard to If S.26(2)

of the RBI Act allows the Union to demonetize ‘all’ currency notes, does it

grant excessive power to the Union?

She observed that If the Central Board of the bank is vested with the power to recommend demonetization of “all” series or “all” denominations of bank notes, the same would amount to a case of excessive vesting of powers with the Bank.

With regard to Whether the

implementation of the 2016 demonetization scheme is flawed?

- Their measure of demonetization

must have been by a way of enacting an act or plenary legislation.

- The proposal for demonetization

from the Government therefore, could not be given effect by way of issuance of

a Notification contemplated under sub section (2) of Section 26 of the Act.

- The impugned Notification

dated 8th November, 2016 issued under Section 26 (2) of the Act is unlawful.

- Further, the subsequent

Ordinance of 2016 and Act of 2017 incorporating the terms of the impugned

Notification are also unlawful.

[i] In which Section 26(2) provides that “On the recommendation of the Central Board the Central Government may, by notification in the Gazette of India, declare that, with effect from such date as may be specified in the notification, any series of bank notes of any denomination shall cease to be legal tender.”

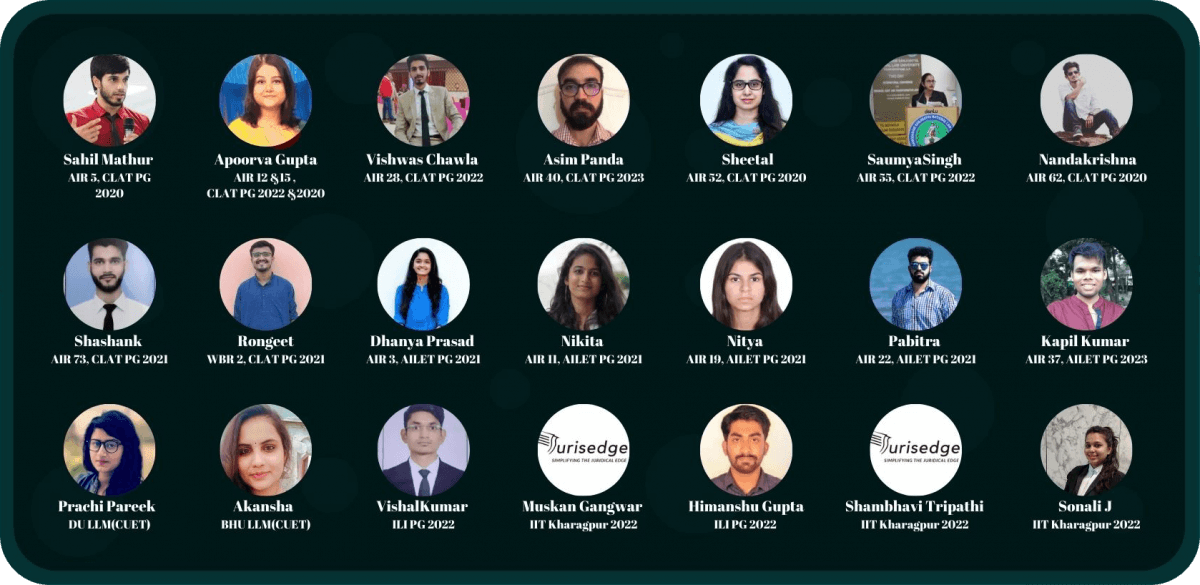

Related

Jurisedge Academy

Share post:

Recently, the Supreme Court Constitution Bench in Vivek Narayan Sharma v. Union of India, 2022 SCC Online SC 1 has upheld by a 4:1 majority the notification of demonetization taken six years ago by the Union Government to demonetize the currency notes of Rs. 500 and Rs.1000. Justices S Abdul Nazeer, BR Gavai, AS Bopanna, V Ramasubramanian gave the majority opinion whereas Justice BV Nagarathna dissented.

Before delving into the analysis of the judgment, let’s understand what demonization is. Demonetisation is referred to as “the process of stripping a currency unit of its status to be used as a legal tender” In simple words, demonetization is the process by which the demonetized notes ceases as a legal currency, and no transaction can be done by it, i.e., the legal currency that is demonized has no value in the eyes of the law.

Background of the Case

A notification dated 8th November 2016 was issued by the Central Government declaring that bank notes of denominations of five hundred rupees and one thousand rupees shall cease to be legal tender with effect from 9th November 2016. The said notification was issued in the exercise of the power conferred to the Central Government under Section 26(2)[i] of the Reserve Bank of India, 1934. Soon after the issuance of the said notification, several writ petitions were filed in different High Courts and also the Supreme Court. Hence, for the sake of convenience and transfer petitions filed by the Union, the issue was taken up by the three-judge bench of the Supreme Court, which further transferred it to the present five-bench judge. It is to be noted that there are many different issues tackled by the hon’ble Supreme Court, but I would like to elucidate the points important for CLAT PG & Other Law Entrance Exams.

Issued framed by the Court & Its Reasoning

Issue 1: Whether the Central Government can demonetize ‘all’ currency notes of a denomination through a notification under S.26(2) of the RBI Act?

To find a solution to this issue, the Supreme Court analyzed the word “any” series of bank notes of any denomination shall cease to be legal tender. While analyzing the word “ any”, the Court referred to an important principle of interpretation of statutes i.e. Purposive Interpretation.

It referred to a plethora of cases, such as Modern Dental College and Research Centre, M/s Girdhari Lal and Sons v. Balbir Nath Mathur, and observed that purposive interpretation is the one that adds value to the purpose of the act or advances the purpose of the act. Such interpretation ensures that a smooth and harmonious working must be chosen and any interpretation that causes confusion, or friction between various provisions, and that tends to destroy the purpose of the act must be neglected. Hence, it is the duty of the Court to strive to interpret the statute to promote or advance the object and purpose of the enactment. And for the fulfilment of this duty, the Court can part from the plain meaning of the word.

The Supreme Court further analyzed the purpose of Section 26(2) of the RBI Act which gives power to the Central Government to demonetize any notes, on recommendation from the Supreme Court. And, viewed as follows:

Issue 2: Whether Section 26(2) of the RBI Act allows the Union to demonetize ‘all’ currency notes, does it grant excessive power to the Union?

It was contended that Section 26(2) of the RBI Act vests “unanalysed, unguided and arbitrary powers” in the Central Government and the provision is liable to be struck down. In this aspect, the Supreme Court delved into the concept of delegated legislation and referred to a plethora of cases Hamdard Dawakhana (Wakf) Lal Kuan, Delhi and another, Harakchand Ratanchand Banthia and others, etc. Also, referring to the case of Rojer Mathew Case, the Supreme Court observed that “a mere possibility or eventuality of abuse of delegated powers in the absence of any evidence supporting such a claim, cannot be a ground for striking down such a provision.”

Further, the Apex Court observed the important role of the RBI as a Central Bank to justify the fairness of the delegated legislation. It observes that RBI, a bankers’ bank, is a creature of statute and one of its important functions is to regulate the banking system in the country. In the case of Peerless General Finance and Investment Co. Limited and another, it was held that “it is not permissible for a Court to advise in matters relating to financial and economic policies for which bodies like the Reserve Bank are fully competent.”

Hence, the Supreme Court held as follows:

Hence, Section 26(2) of the RBI Act does not suffer from the vice of excessive delegation.

Issue 3: Whether the implementation of the 2016 demonetization scheme is flawed?

It was contended that decision making power at the stage of making recommendations by the Central Board and at the stage of taking decisions by the Central Government is flawed, as irrelevant factors were taken into consideration to enforce demonization.

To answer this issue, the Scope of Judicial Review was taken into consideration:

The Supreme Court referred to the landmark case of Tata Cellular Case, which held: “The Supreme Court must confine its judicial review to the question of legality i.e if the decision-making authority exceeds its power, committees an error of law, breached the rule of natural justice.” The Court also referred to M/s. Prag Ice & Oil Mills and Another v. Union of India, R.K. Garg v. Union of India and Others and a recent case of Small Scale Industrial Manufacturers Association (Registered) v. Union of India and Others, to come to a conclusion that it is not the function of this Court to sit in judgement over such matters of economic policies. And, they can certainly not be expected to decide them without even the aid of experts. Hence, the Court examined the said demonization on legal grounds. And, found that it was not arbitrary

The Supreme Court held as follows:

Therefore, the Supreme Court did not find any flaw in the decision-making process as required under Section 26(2) of the RBI Act.

Issue 4: Whether the demonetization exercise is liable to be struck down by applying the test of proportionality?

It was contended that the act of demonetization caused hardships to a number of citizens; hence the Government ought to have found out whether there was an alternate course of action which could have resulted in lesser hardship to the citizens.

Here, the question of the test of proportionality comes into the picture. The Supreme Court referred to the case of Modern Dental College and Research Centre it elucidated four tests of proportionality:

The Supreme Court on this issue held as follows:

Therefore, the impugned notification dated 8th November 2016 does not violate the principle of proportionality and as such, is not liable to be struck down on the said ground.

Issue 5 & Issue 6: Was the 52-day window provided to exchange demonetized notes unreasonably short? Can the RBI exchange demonetized currency after the 52-day window?

It was claimed that the exchange of old notes with new notes under the impugned Notification is unreasonable. The Supreme Court referred to the case of Jayantilal Ratanchand Shah which held that in previous demonetization in India (1978) if the time for such exchange was not limited, the high denomination bank notes could be circulated and transferred without the knowledge of the authorities concerned. And the very purpose of the demonetization would be defeated.

And, in regard to the question of can the RBI exchange demonetized currency after the 52-day window. The Court observed that the RBI does not possess independent power to do so as per the 2017 Act.

Dissenting opinion:

Justice Nagarathna differentiated in two issues:

Whether the Union demonetize ‘all’ currency notes of a denomination through a notification under S.26(2) of the RBI Act?

Justice Nagarathna observed the following:

With regard to If S.26(2) of the RBI Act allows the Union to demonetize ‘all’ currency notes, does it grant excessive power to the Union?

She observed that If the Central Board of the bank is vested with the power to recommend demonetization of “all” series or “all” denominations of bank notes, the same would amount to a case of excessive vesting of powers with the Bank.

With regard to Whether the implementation of the 2016 demonetization scheme is flawed?

[i] In which Section 26(2) provides that “On the recommendation of the Central Board the Central Government may, by notification in the Gazette of India, declare that, with effect from such date as may be specified in the notification, any series of bank notes of any denomination shall cease to be legal tender.”

Share this:

Related