|

Name of the

Case

|

Held

|

|

Engineering Analysis Center for Excellence v.

Commissioner of Income Tax, 2021 SCC Online SC 159

|

Settling an important issue in the Income Tax Law, a

the Supreme Court held that the amounts paid by Indian companies for the use

of softwares developed by foreign companies do not amount to ‘royalty’ and

that such payment do not give rise to income which is taxable in India.

Therefore, there is no liability for Indian companies to deduct tax at source

with respect to purchase of software from foreign companies.

|

|

Principal

Commissioner of Income Tax (Central) – 2 v. Mahagun Realtors (P) Ltd.,

2022 SCC Online SC 407

|

The

Supreme Court clarified a seemingly settled point of law regarding the

validity of an Income Tax notice issued to a transferor company after its

amalgamation. While the common belief was that transferor entities cease to

exist, having undergone corporate death upon amalgamation, the Supreme Court

held that an amalgamation does not automatically invalidate an assessment

order issued in the name of the transferor company.

|

|

Principal

Director of Income Tax (Investigation) v. Laljibhai KanjiBhai Mandalia, 2022

SCC Online SC 872

|

The

Supreme Court reiterated the principles governing writ jurisdiction in the

context of search and seizure under Section 132 of the Income Tax Act. It

noted that the adequacy or insufficiency of the reasons recorded cannot be

examined when assessing the validity of an authorization for search and

seizure. The recorded belief is justiciable only in light of the Wednesbury

Principle of Reasonableness.

|

|

K.L. Swamy v. Commissioner of

Income Tax, 2023 SCC Online SC 44

|

The

Supreme Court affirmed that the revenue was justified in imposing interest

under Section 158BFA(1) of the Income Tax Act for the late filing of returns

for the block period, even without a notice under Section 158BC and for the

period prior to June 1, 1999. The Court examined the rationale, objectives,

and purpose of Chapter XIV-B, which governs block assessments, noting that

this provision establishes a special procedure for cases involving searches.

The primary aim of including this provision was to address tax evasion, and

to expedite and simplify the assessment process in such cases.

|

|

Income Tax Officer

v. Vikram Sujitkumar Bhatia, 2023 SCC Online SC 370

|

The

Supreme Court observed that the amendment to Section 153C of the Income Tax

Act, 1961, introduced by the Finance Act, 2015, applies to searches conducted

under Section 132 before June 1, 2015, the date of the amendment. The purpose

of Section 153C is to address issues involving individuals other than the

person directly searched. The 2015 amendment was introduced to address the

narrow interpretation of “belong/belongs” in Section 153C by the

Delhi High Court in the Pepsico Holdings case. This narrow interpretation had

previously prevented the Revenue from taking action against third parties

even when incriminating material related to them was discovered during search

proceedings under Section 132.

|

|

SAP Labs India Pvt. Ltd. v. Income Tax Officer, Circle

6, Bangalore, 2023 SCC Online SC 449.

|

The

Supreme Court has ruled that the High Court is not barred from reviewing the

arm’s length price determined by the Income Tax Appellate Tribunal (ITAT)

under its powers pursuant to Section 260A. The bench also stated that there

is no absolute rule that the Tribunal’s determination of arm’s length price

is final and immune from scrutiny by the High Court in an appeal under

Section 260A.

|

|

Mansarovar

Commercial Pvt. Ltd. v. Commissioner of Income Tax, Delhi, 2023 SCC Online SC 386

|

The

Supreme Court upheld the jurisdiction of the Assessing Officer in New Delhi

to tax the income of assessees incorporated under the Registration of

Companies (Sikkim) Act, 1961, for assessment years prior to when the Income

Tax Act, 1961 was extended to Sikkim. Since the control and management of the

assessee companies were based in New Delhi with their auditor, the Income Tax

Act, 1961 applied to them. Consequently, these companies, incorporated under

Sikkim’s company law, were considered resident Indian companies, and their

income accrued or earned in India for assessment years before April 1, 1990,

was taxable under the Income Tax Act.

|

|

Excise Commissioner Karnataka & v. Mysore Sales

International Ltd., 2024 SCC Online SC 1660

|

The

Supreme Court ruled that a vendor who purchases liquor from state

manufacturers without going through an auction and sells it at a fixed price

is excluded from the definition of ‘buyer’ under Section 206C of the Income

Tax Act. Such transactions are exempt from Tax Collected at Source (TCS). The

Court clarified that to be excluded from the ‘buyer’ definition under Section

206C(1) as per Explanation (a)(iii), two criteria must be met: (a) the goods

must be obtained without auction, and (b) they must be sold at a price fixed

by the state government.

|

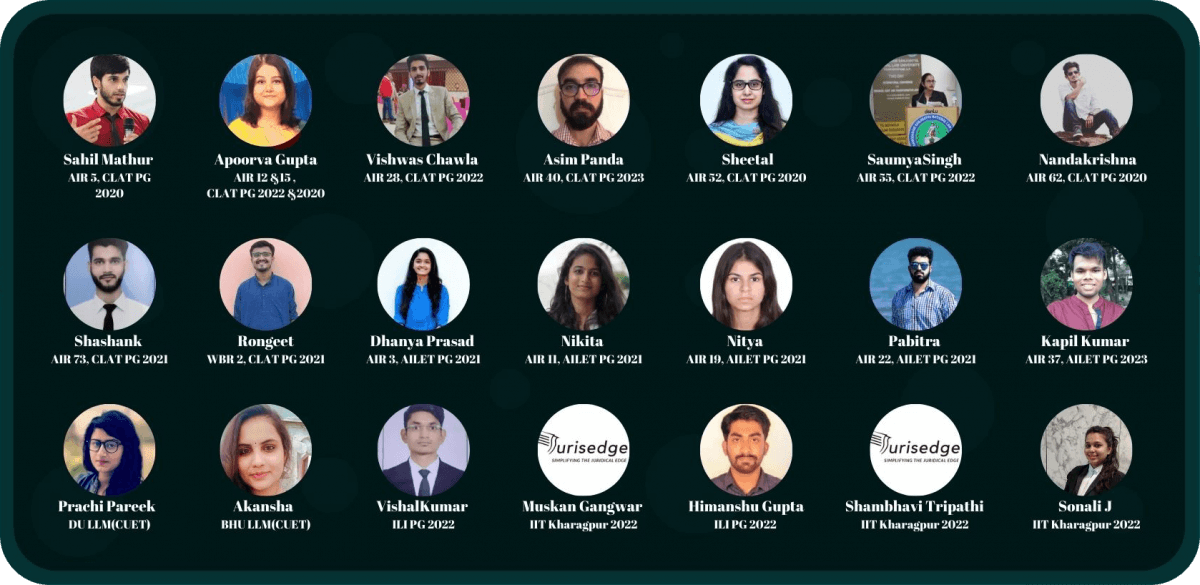

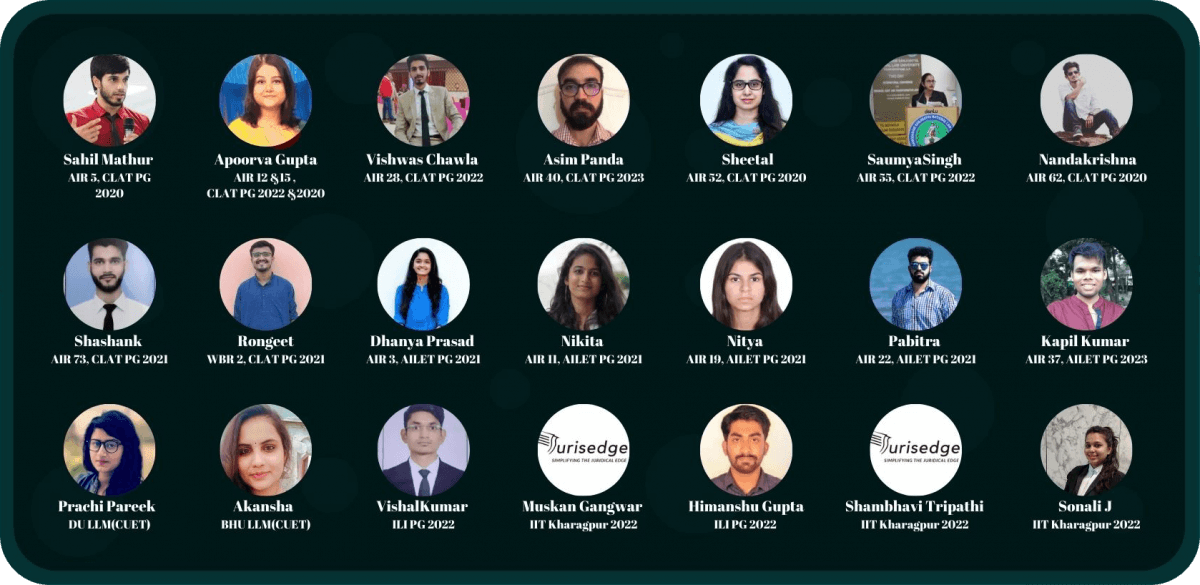

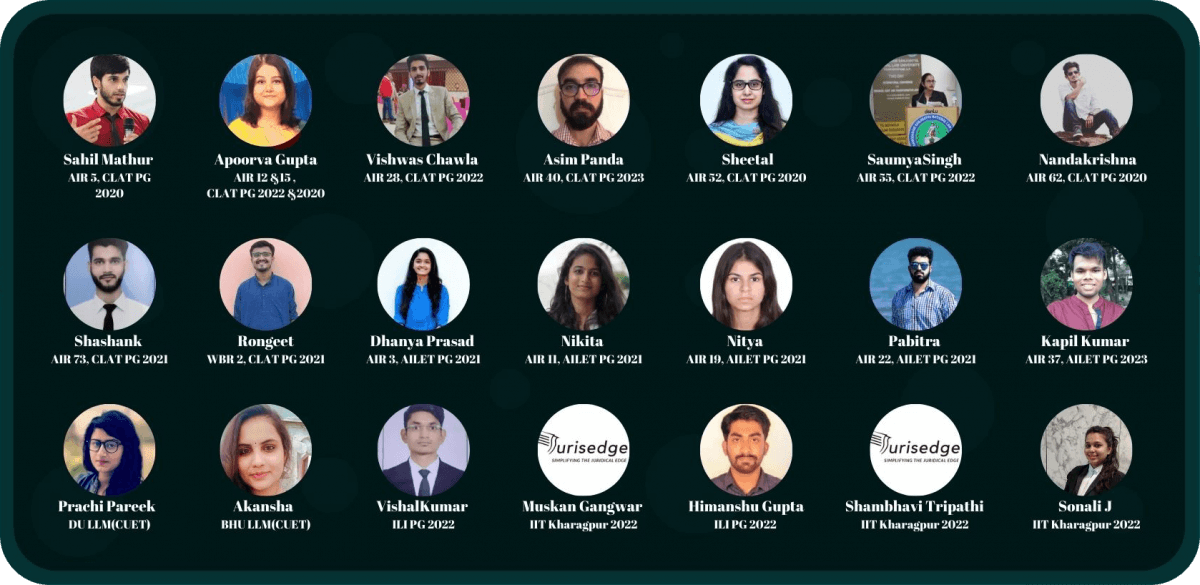

Jurisedge Academy

Share post:

In this Landmark Judgment Series celebrating 8 years of Jurisedge, we turn our focus to the Landmark Series for the Tax Law 2020-2024.

The landscape of Tax Law from 2021 to 2024 has been marked by significant judicial pronouncements, making it important and attractive subjects for examiners. The Supreme Court has delved into various topics such as taxation of payments for software developed by foreign entities, impact of amalgamation on tax assessments, principles governing the validity of search and seizure authorizations, application of interest for late filing of returns under specific provisions, applicability of amendments related to third-party issues in search cases, The scope of High Court review over ITAT’s arm’s length price determinations, The jurisdiction of tax authorities over companies incorporated under Sikkim’s laws, The definition of ‘buyer’ and exemptions from Tax Collected at Source (TCS) for liquor transactions.

We have already covered various subjects like Constitutional Law, Administrative Law, Indian Penal Code, Evidence Law, Environmental Law and Company Law.

Share this:

Related

Round-Up: Judgment Series 2020-2024

Welcome to our comprehensive roundup of the Judgment Series for 2020-2024! In this series, we’ve explored the evolving landscape of Indian jurisprudence through detailed reviews and interpretations of landmark cases. read more…

Share this:

Judgments Series 2020-2024: High Courts

The High Courts in India have delivered significant rulings relating to constitutional, criminal, administrative matters, etc. This blog post will take a round up of some of the important judgments. read more…

Share this:

Judgments Series 2020-2024: Company Law

In this Landmark Judgment Series celebrating 8 years of Jurisedge, we turn our focus to the Landmark Series for the Company Law. The landscape of Company Law from 2020 to 2024 has. read more…

Share this:

Judgments Series 2020-2024: Environmental Law

In this Landmark Judgment Series celebrating 8 years of Jurisedge, we have covered Landmark Series on Constitutional Law, Administrative Law, Indian Penal Code, CrPC, and Evidence. Now, we turn our focus to the. read more…

Share this: